It’s a normally asked dilemma, and one that numerous dream about or perhaps aspire to gain, so we thought you would put out some sort of survey with the people of recent Zealand to be able to gauge the amount of money persons think that they must live the life without having to work or perhaps rely on personal savings.

The whole six-question integrated questions about: how much they presume is needed to will no longer need to job or depend on savings; just how well they’d live in the event said amount of money was won; just what they’d perform about their present career; just how private they can keep the statement of their huge win; simply how much they’d give friends, friends and family, or charitable trust; and if they’d stay in Brand USA.

Primary of the queries was about the thinking that A amount of money may last these people for 4 decades without having to do the job again or perhaps rely on personal savings, so persons in the age ranges of 35-44 and 45-54 provided essentially the most acute files for the dilemma as 4 decades for them will in all probability see these people through retirement life and to the finale of their your life, but the different age groups even now provided vital data, which will we will as well examine.

Ahead of we look into the results belonging to the survey, many of us further really need to define the amount someone would really need to gain all at once to live suitable for 40 years. In line with the US-based CNBC, it absolutely was found of which US$1 zillion may only previous someone more than a decade, meaning that when considering 40 years, persons would need US$3. 2 zillion, which turns to USA$4. 7 zillion. Money Wise, some sort of UK profits expert web-site, found one of those who plans to maintain on £12, 000 annually, which would simply entail a purpose for £480, 000 (NZ$927, 000) above 40 years, nonetheless less low-priced and more normalised calculations clocked in at a desire for £1. 6th million (NZ$3. 1 million) for 4 decades of existing.

The particular cultural societal variations will certainly get their say during these calculations, therefore the truth to get a fair total live off associated with without being excessively frugal meant for 40 years probably sits within the USA$3 mil to USA$4. 5 mil range. Within USA, the 2018 Living Wage was at an annual rent of USA$42, 744, resulting in the primary over 4 decades from this residing wage becoming USA$1. seven million, yet this would probably entail an extremely frugal lifestyle, so we prolonged the range enabling unexpected costs, entertainment investing, rent or even mortgage payment, fundamental household products, and all other costs that would require covering more than 40 years but still allow the weed to are that time period.

Dilemma 1: The amount of money do you think you’d have to acquire to serve you for 40 years (without having to do the job again or perhaps rely on savings) [in USA$]?

Problem 1 was initially split into eight answers, using participants picking one of the next: 1 thousand to 1. 99 million; a couple of million to be able to 2 . 99 million; two to three million to three. 99 thousand; 4 thousand to some. 99 thousand; 5 thousand to 6. 99 million; 8 million to be able to 9. 99 million; twelve million-. Seeing that has been well known by Us media, men and women dream of earning US$1 thousand as it’s portrayed to be enough to fix all budgetary problems, and we decided to collection the low-end of the review at USA$1 million.

The dominating twenty-eight per cent with the respondents ticked the 12 million- solution, with the following most popular solutions being the two million in order to 2 . 99 million variety with an eighteen. 4 % of those selected, closely then the of sixteen per cent who also thought that just one million to at least one. 99 , 000, 000 would be sufficient money in order to last all of them for 4 decades without having to job again or even rely on cost savings. Across the 2 categories, the combined something like 20 per cent associated with voters noticed in line with our own calculations with the quantity necessary to live just for 40 years.

Age groups of specific intrigue, 35-44 and 45-54, combined for any majority that will saw two million in order to 2 . 99 million being the amount required with twenty three. 1 %. 10 million- followed along with 20. five per cent, soon followed by seventeen. 9 % going for the particular 1 mil to 1. 99 million choice.

Granted the vision context on this question, prudent that many would definitely select the USA$10 million- alternative as it’s a huge amount of funds reserved for the most significant of victories. Take the environment record-breaking jackpots from sophisicated slot activity Mega Moolah, for example; that currently supports the official environment record payment at USA$25. 4 zillion as well as the not-yet officially approved new world document of USA$31. 3 zillion. In fact , the modern Mega Goldmine win at the game by the USAer clocked throughout at USA$8. 3 zillion, which used fellow Kiwi wins involving USA$1. 6th million, USA$10. 1 zillion, and USA$1. 1 zillion. Then there’s the added hoopla around the largest gambling function in the world, the earth Series of Holdem poker, which has presented huge start prizes involving USA$26. six million, USA$22. 3 zillion, USA$17. some million, together with two a lot of USA$14. 6th million ever since 2006. Hence while these kinds of wins aren’t unheard of, in USA, they are even now considered vision and thought of in line with the vision of do not ever having to do the job again.

General, it’s clear why a lot more people will select the best value since it would give all of them more freedom in their daily lives and let them to survive more extravagantly. The highest choice was also the particular safest for the reason that even the the very least financially or even mathematically knowledgeable person will be safe choosing 10 , 000, 000 or more as being a big enough succeed to live away from for 4 decades. The two cheaper values obtained a strong portion of the ballots, likely addressing those who construed the question for the reason that amount necessary for them to remain exactly as vehicle for the next 4 decades, or something such as this thought.

Issue 2: In case you won how much money indicated involved 1, supposing you had most income, can you be able to:

To reply to this problem, 8. two per cent stated that if they gained the amount they selected under consideration 1, it may well enable these to live frugally for 4 decades, 29. your five per cent stated that the amount will let them survive a modest lifestyle, forty two. 6 % would survive comfortably while using amount they selected, in addition to 19. 8 per cent stated that they would survive luxuriously. Provided that a put together total regarding 45. six per cent chosen options by 5 , 000, 000 to twelve million-, this shouldn’t be surprising that the majority (62. 3 each cent) believed that they can live pleasantly or extravagantly for 4 decades if they gained that amount.

Oddly enough, from the crew which chosen live frugally, 50 % were through the group that will picked 12 million- under consideration 1, which means that they look at an average of USA$250, 000 each year at a minimum needing a cost-effective lifestyle. Nevertheless this considerably anomalous choosing is very well countered with the 52. four per cent of the people who chosen the survive luxuriously choice being in the particular 10 million- group.

Of people who were in accordance with our quotes in Question you (selecting both the 3 to three. 99 thousand or some to some. 99 thousand option) forty seven. 1 percent saw these kinds of amounts to be enough so they can live somewhat or pleasantly.

Dilemma 3: When you won adequate money to be able to last you 4 decades (without being forced to work once more or count on savings), what exactly would you chouse terms of your respective career?

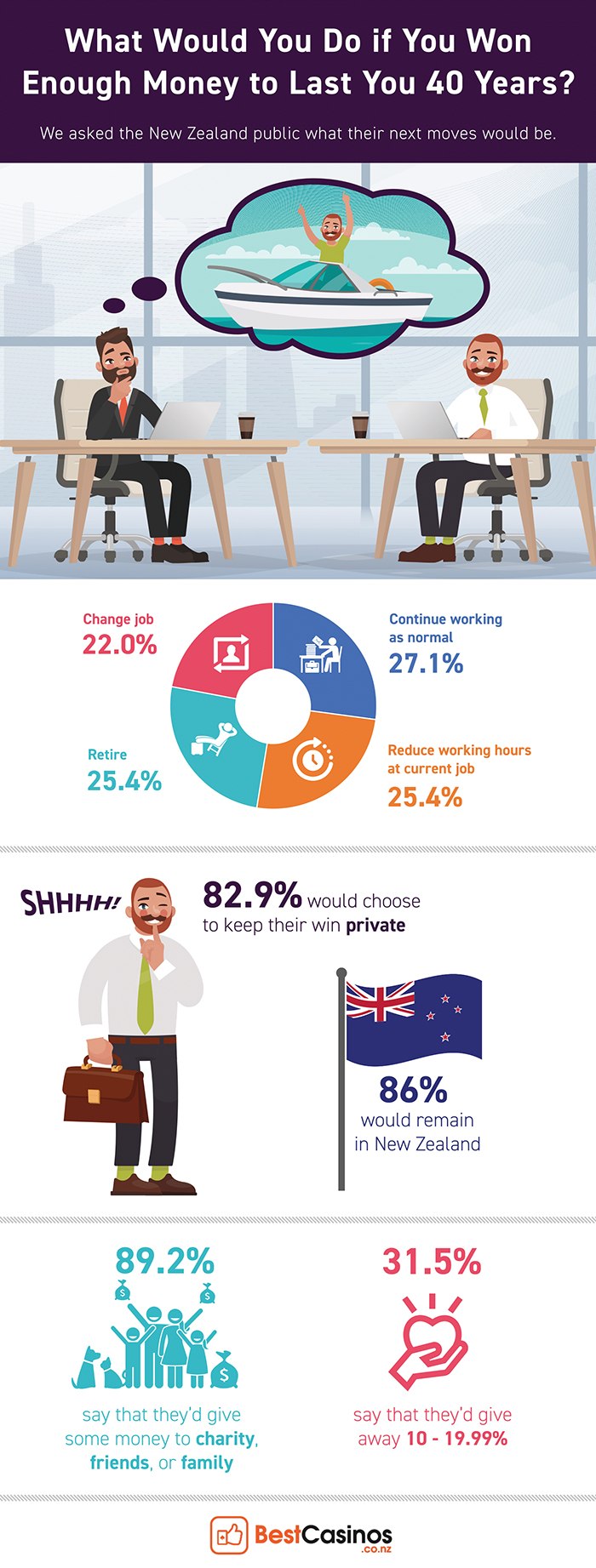

The particular voting with regards to Question 5 was break up fairly equally with 28. 1 % of participants opting to carry on working like normal, twenty five. 4 % reducing the significant hours on their present job, twenty five. 4 % choosing old age, and twenty two per cent modifying their career.

Over the age groups associated with 35-44, 45-54, 55-64, 65-, thirty-one. 8 % selected pension (the many selected choice when merging these 4 groups), that is understandable while having sufficient money to determine them via 40 years is very possibly sufficient to see these to the end of the lives in a lot of instances. The final results also revealed some difference between men and women, with thirty-two. 6 % of men retiring issues selected amount of cash to final them designed for 40 years when compared with only twenty one. 2 % of women doing the exact same.

Typically the relatively few respondents picking the move option is normally somewhat of your surprise since the premise is usually that the amount of money they select is plenty to previous them to have 40 years, considering the majority convinced that their picked amount of money will need to see these people live a new moderate or perhaps comfortable life style. Of the fraction of people who would probably continue to are normal, a tremendous 23. five per cent in addition selected 15 million- as a general win just right to see these people no longer really need to work or perhaps rely on financial savings. This prefer to continue to operate some ability, as revealed by seventy four. 5 percent of members, could fall to work environment friendships, the requirement to keep populated, the arr�ters having a true fondness of these job or perhaps the prospect of your different task, or the social influence to be able to contribute create more money.

Concern 4: Should you won adequate money to be able to last you 4 decades (without being forced to work once more or count on savings), will you want it being publicly released or maintained private?

Not surprisingly, the vast majority of persons answered that they can would have their major win privately owned, with 82. 9 percent ticking have private, six. 2 percent going for a common announcement for the win, together with 9. on the lookout for per cent not really caring regardless.

Inspite of the view regarding younger people getting somewhat bold when it comes to cash, the largest rendering of an age bracket among those would you make a people announcement seemed to be of the 45-54-year-olds at 16. 3 %, with that similar age group getting the only one in order to tally a new ‘kept private’ percentage under 80 % (76. two per cent).

Strangely enough, 42. being unfaithful per cent would you publically mention the big get also thinks that the get noted under consideration 1 could only allow them live frugally for 4 decades. Of the majority of those would you keep the huge win non-public, a fifty-one per cent the greater part would keep work as usual or just decrease their job hours on their present job.

Issue 5: In the event you won sufficient money in order to last you 4 decades (without the need to work once again or depend on savings), just what proportion can you donate in order to charity or even gift in order to family/friends?

This is actually classic dilemma posed to several figurative goldmine winners, and even though the vast majority of persons say that they would frequently share typically the wealth with the [xyz-ihs snippet="table"]friends, family unit, or nonprofit, the results of your survey noticed that a good portion of some of those questioned have been a bit stingy. Of the participants, 10. seven per cent mentioned that they would offer 0 percent, 18. zero per cent mentioned that they’d offer 0. 01 to 5. 99 percent of their acquire, 19. seven per cent mentioned that they’d offer between several and on the lookout for. 99 percent, the most popular alternative was to offer 10 to be able to 19. 99 per cent by using 31. some per cent deciding on this option, and next 19. seven per cent gives up 15 per cent or maybe more of their newly found wealth.

It absolutely was found of which females are often more full than guys, with 63. 2 percent of all ladies surveyed selecting to beat the 15 to nineteen. 99 percent or 10 per cent- box when only 43. 6 percent of guys did in the same way. The results shown the age sets of the most fascination (35-44 and even 44-54) made up 65. 6 per cent belonging to the selections belonging to the two nearly all generous alternatives. Somewhat of odd seeking was that on the lookout for. 5 percent of those who give 10 per cent- also thought that all their major win that could be enough suitable for 40 years would most likely also bring about them primary a inexpensive life.

Dilemma 6: When you won adequate money to be able to last you 4 decades (without being forced to work once more or count on savings), might you stay in Fresh Zealand or perhaps move in another country?

In this question, there were a simple pair of two responses: stay in Fresh Zealand or perhaps move in foreign countries. A massive eighty six per cent of your 107 participants declared they would continue in USA if they acquired enough funds that they wouldn’t have to worry about operate or count on savings available for 40 years.

This shouldn’t be surprising that the 18-24 age group was your most venturous, with thirty-three per cent saying that they’d go overseas compared to just ten % of those elderly 65-years-old or higher. Possibly associated with these results: 40 % of those which stated that will they’d approach abroad furthermore selected that will they’d alter their work if they reeled in the large win. Whilst not as low as the particular 65- age bracket, but just 15. two per cent of individuals in the 35-44 and 45-54 age groups would certainly leave Brand USA in this case.

The activity of the majority

There they are: if someone was going to win sufficient money to be able to last these people 40 years, the majority of folks would expect that quantity to be in more than USA$10 zillion and for that to allow them to dwell comfortably. Following landing the top win, they’d most likely proceed working simply because normal nonetheless would keep on their newly found wealth privately owned. But simply being private doesn’t mean simply being greedy, for the majority of persons would reward 10 to be able to 19. 99 per cent with their win to be able to charity, the friends, or perhaps their family unit, most likely remaining in USA to enjoy more of their money.